Spring Property Market Heats Up Despite Record-Low Listings

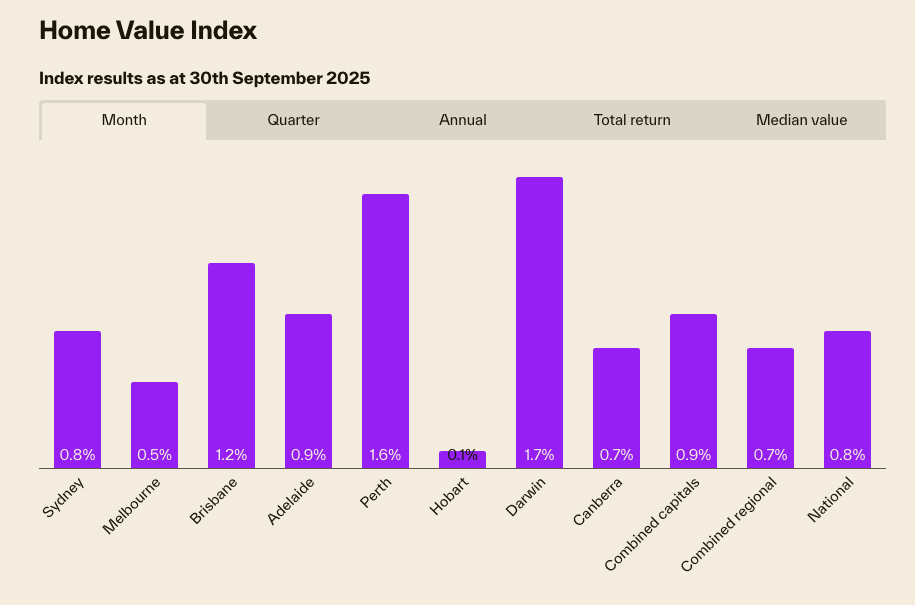

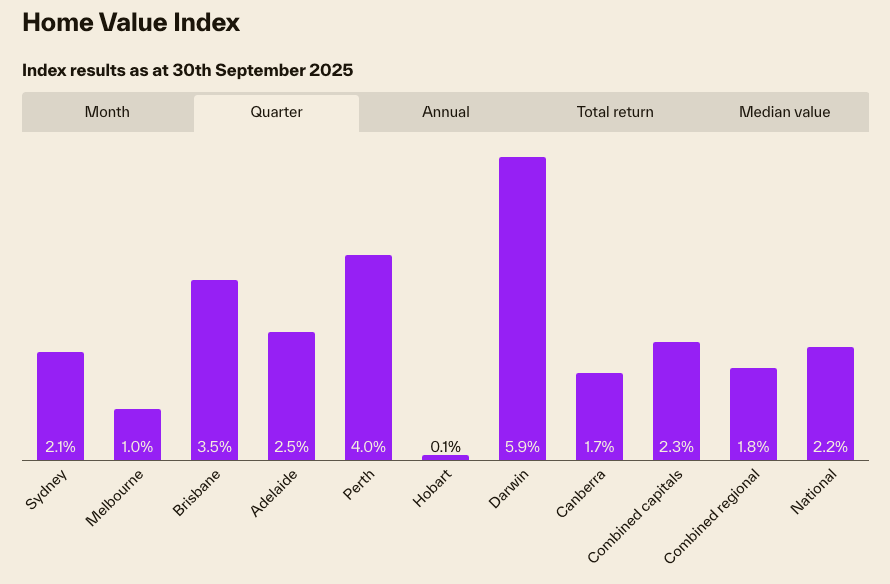

According to Cotality data, September delivered the strongest monthly rise in dwelling values since October 2023, with the national index up 0.8%. Quarterly growth reached 2.2%, adding around $18,000 to the median dwelling value. Every capital city and regional market recorded gains, confirming broad-based momentum.

From my perspective, this is not just a short-term bounce. The combination of scarce supply, government-backed buyer incentives, and improved borrowing power is creating a competitive environment that will likely push values higher into the summer months.

Capital Cities Driving the Upswing

Cotality reports that:

Darwin led with 5.9% growth over the quarter.

Perth surged 4.0%, driven by demand for units.

Brisbane rose 3.5%, with units outpacing houses for the seventh consecutive quarter.

Hobart also saw unit growth outpace houses.

In my view, Brisbane’s ongoing unit strength is particularly important. For years, Brisbane apartments lagged, but now supply shortages are turning them into a growth leader — a reversal investors should not ignore.

First-Home Buyers Back in the Game

The expanded Home Guarantee Scheme is a double-edged sword. On one hand, Cotality data shows that nearly half of all suburbs now sit under the new price caps, allowing more first-home buyers to enter the market.

On the other hand, from my experience, these schemes often fuel extra competition in already tight segments. First-home buyers may finally have the support to get in, but they’re now bidding against a larger pool of similarly supported buyers.

Listings Hit Historic Lows

Cotality highlights that advertised listings remain 18% below the five-year average across the capitals, and down an extraordinary 53% in Darwin. Yet sales activity is still running 7.3% above average.

This imbalance tells me the current upswing has legs. Unless stock levels lift significantly, even a moderate rise in demand will keep pressure on prices.

Sellers Regain the Upper Hand

Auction clearance rates have held around 70% since mid-August, up from ~62% earlier in the year.

For me, this is the clearest sign of where the market stands: buyers are chasing fewer homes, and sellers are dictating terms. Well-priced properties, especially in affordable and middle-market suburbs, are selling quickly and often above reserve.

Final Thoughts

Cotality’s September data confirms what many of us in the industry are feeling on the ground — the market is heating up again. With supply this tight and demand being bolstered by incentives and lower rates, conditions are firmly tilted towards sellers.

My view: buyers need to act decisively with pre-approvals in place, while sellers should see spring as a golden window to list.

👉 Before making a move, use our Stamp Duty Calculator to understand your upfront costs and plan smarter in today’s fast-moving market.